Lending

FORGE exists to help entrepreneurs start or grow small businesses by providing high quality business management, planning and support services in addition to its loan programs. We are committed to empowering you to expand your economic opportunity through business ownership, because we believe that successful locally-owned businesses create opportunities for families and communities.

FORGE is a CDFI, or community development financial institution, that provides capital and business development services designed to help individuals start and grow successful small businesses; to build communities through collaborations with other non-profits, higher education institutions, corporations, and public agencies; and to create scalable program models with measurable impact that can be replicated in communities across Arkansas and the Ozarks. To achieve these goals, FORGE works with a number of partner organizations across the state and region, including:

What is a CDFI?

CDFIs are private financial institutions that are 100% dedicated to responsible, affordable lending to help low-income, low-wealth, and other disadvantaged people and communities join the economic mainstream. By financing community businesses—including small businesses, microenterprises, nonprofits, commercial real estate, and affordable housing—CDFIs spark job growth and economic development in hard-to serve markets across the nation. CDFIs are profitable but not profit-maximizing. They put community first, not the shareholder. For more than 30 years, CDFIS have had a proven track record of making an impact in those areas of America that need it most, providing financing and development services to businesses, organizations, and individuals in low-income communities.

What types of businesses does FORGE fund?

The preference of FORGE is toward services in small and/or underserved communities, sustainable agriculture and forestry, and local small businesses that create jobs. Current borrowers include a graphic artist, backhoe operator, goat farmer, florist, midwife, bakery owner, adventure camping operator, and several small manufacturers, to name a few.

What is the application and approval process?

The first step of the process is to complete the FORGE Loan Application. No up-front fee is required, though you must pay a one-time $35 membership fee if your loan is approved. Send the completed application to the FORGE office via mail, email, or fax and you will be contacted by a FORGE staff member. FORGE will review your credit history and, if eligible, you will be asked to schedule a face-to-face visit with the FORGE loan officer, usually at your place of business. The size of your loan request determines the level of underwriting that will take place.

Why borrow from FORGE?

The only fee you will ever be charged (above closing costs) is a one-time $35 membership fee. With good credit, FORGE can offer lower fixed interest rates than traditional banks. FORGE considers loans that other banks may consider too small or nontraditional FORGE provides tools to help borrowers be successful, including technical assistance and mentoring. We have many loan funds that are targeted to specific geographic areas, types of businesses, and other demographic characteristics, as well as a general loan fund. Send your business plan to us today to find out if FORGE can help you achieve your dreams.

The complete FORGE loan application is available HERE.

The General Credit Fund is the primary fund from which FORGE makes mission-aligned loans that do not fit into any of the other lending programs. Loans made from the General Credit Fund have the most flexibility on terms.

Through the Small Business Administration (SBA) Microloan Program, FORGE provides small business loans, business counseling, and technical assistance to start-ups, newly established and growing small business concerns. The maximum loan amount under this program is $50,000; the maximum term for an SBA microloan is six (6) years. The SBA does not review, underwrite, or have the authority to approve or deny a microloan.

The USDA rural development loan programs aim to alleviate poverty and increase economic activity and employment in rural communities. These funds are used to assist with financing business and economic development activity to create or retain jobs in disadvantaged and remote communities.

Maximum loan amounts are $250,000, or 75% of the total cost of project for which loan is made. Borrowers may be individuals, public or private organizations, or other legal entities, given that majority ownership is held by U.S. citizens or permanent residents; the applicant owes no delinquent debt to the federal government; the applicant is unable to obtain affordable commercial financing elsewhere; are located in an eligible rural area (see below); and the applicant has no legal or financial interest or influence in FORGE.

Loan funds may be used for the following purposes: the acquisition, construction, conversion, enlargement, or repair of a business or business facility, particularly when jobs will be created or retained; the purchase or development of land (easements, rights of way, buildings, facilities, leases, materials); the purchase of equipment, leasehold improvements, machinery, or supplies; start-up costs and working capital; pollution control and abatement; transportation services; feasibility studies and fees; hotels, motels, convention centers; educational institutions; and aquaculture-based rural small business.

The IMANI fund provides under-resourced entrepreneurs with technical assistance with patient, flexible capital that matches their needs. The Imani Fund offers microloans ranging from $5,000 to $25,000 to entrepreneurs and uses an innovative and creative approach to underwriting. The underwriting process emphasizes the character of business owners, their ability to execute on their business model and community-engagement efforts. Remix Ideas provides technical assistance and supports businesses to become loan ready.

Kiva Little Rock is a partnership between Kiva, an international nonprofit, and FORGE, Inc. FORGE is serving as a local Hub of Kiva. The Kiva Little Rock Hub is funded through a grant from the Winthrop Rockefeller Foundation. This means you have a dedicated manager in Little Rock to help you at any point in the Kiva lending process.

The Kiva Little Rock Hub works with entrepreneurs throughout the application, fundraising, and repayment process to help them succeed. Check out the requirements and loan sizes below to see if we can help your business grow. Learn more about the Kiva requirement and loan sizes at kivalittlerock.org

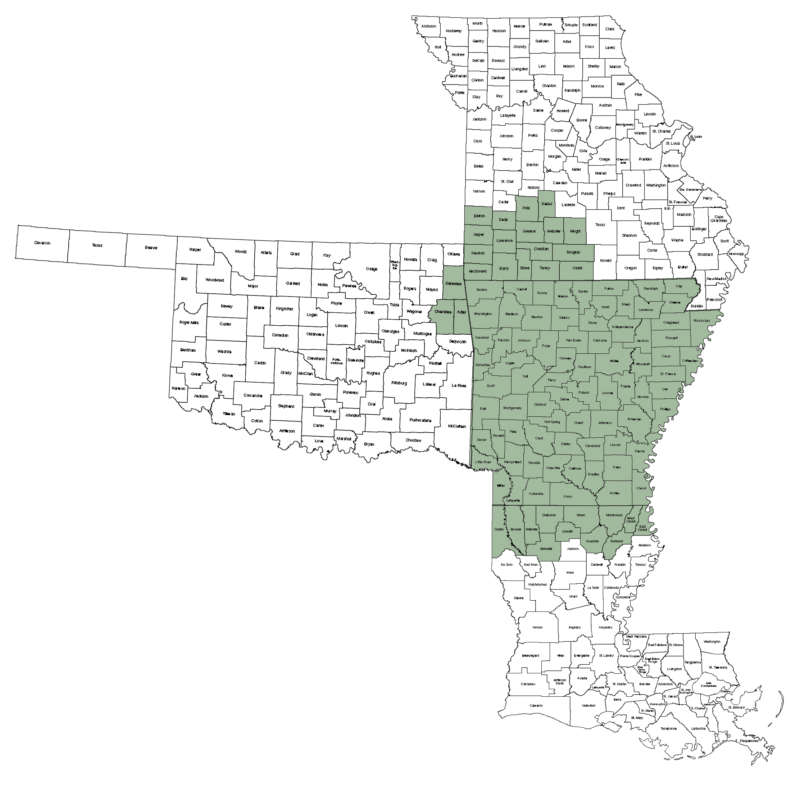

Arkansas

All 75 counties

Oklahoma

Adair, Cherokee, Delaware counties

Missouri

Barton, Jasper, Newton, McDonald, Dade, Lawrence, Barry, Polk, Greene, Christian, Stone, Dallas, Webster, Douglas, Ozark, Wright, Texas, and Howell counties

Louisiana

Caddo, Bossier, Webster, Claiborne, Bienville, Union, Lincoln, Ouachita, Richland, Morehouse, West Carroll, and East Carroll